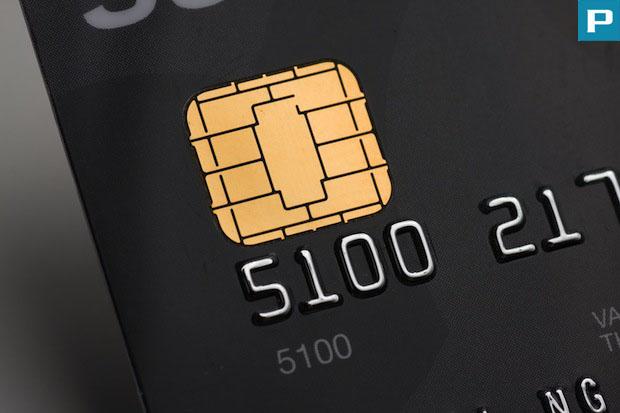

Three Things to Know About EMV ‘Chip’ Credit Cards

EMV or “chip” credit cards are the new standard for credit cards equipped with computer chip technology. There are currently more than a billion in circulation, so many consumers are already using them. The embedded identity theft protection feature means that counterfeiters and card thieves won’t be able to authenticate bogus transactions, making credit card transactions safer for consumers. Read on to learn more about these tiny computer processors residing in our wallets.

How does the chip security feature work?

Unlike the traditional magnetic strips cards, which could be copied fairly easily by counterfeiters, EMV cards create a unique transaction code for each and every purchase. Even if copied, these codes cannot be used more than once. While this doesn’t address data breach prevention in general, it means that consumers can rest easy knowing their cards cannot be duplicated even if their credit card information is stolen.

What does this mean for a consumer making a chip card purchase?

It should still be quick and easy to pay with a chip card – the mechanics are simply a bit different. Rather than traditional card swiping, “card dipping” is the norm. This is the process of inserting your card into the chip reader, then simply waiting for the card terminal to read the card and verify the transaction.

Do I still need a PIN for transactions?

This will vary from card provider to card provider, but the vast majority of cardholders will continue to use signature verification to complete a purchase. If you happen to be in the minority and use a “chip and PIN’ card, you will still need a PIN to complete transactions.

For more specific information on your EMV card, contact your card provider’s customer service line.

Image via Flickr/paymentmaxprocessing